The BCG matrix helps to get the complete picture of your business.

Chess is an interesting game. It has a lot of commonalities with business.

I am an amateur chess player. How much ever I tried, I couldn’t win a game.

I consulted a chess trainer, he said “Ramesh your problem is, you are thinking of your next move, you are not looking chessboard as a whole; you see it in bits and pieces.

Yes, he is right. I couldn’t get the complete picture.

The difference between the amateurs and grandmasters like Vishwantahan Anand is, grandmasters see the chessboard as a whole, not in bits and pieces

The questions came to my mind: Am I playing the business also in bits in pieces? Can I see the complete picture, where my business is growing, where it’s lacking, where to cut, where to grow?

Do we entrepreneurs are seeing our entire business or product lines as a complete picture,

Not always

We get emotionally attached to a product or a business, failing to see the complete picture of our business

Could we see the complete picture of our business?

Yes

The BCG matrix helps to get the complete picture of your business

Developed by Boston consulting group in 1968, it is still one of the widest used business strategy tools used by Fortune 500 companies to Small &Medium Business

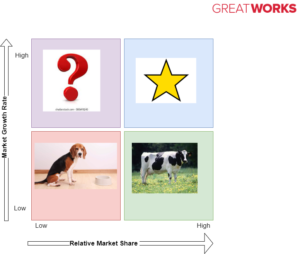

This is a simple four-quadrant box with visual aids and easy-to-understand metaphors, that helps entrepreneurs to decide, where to prioritize, where to invest, where to dis-invest, can this business be sold or retained

How to work on the growth-share matrix

Before doing this exercise, you need to have all the business data, at least the last two to three years of data are needed.

Don’t do with your intuitive understanding of your business. We need real hardcore numbers. In one of our consulting engagements, it surprised the business owner to see one of his products is actually draining cash & valuable resources shattered his long-time belief that the product is doing well.

So get all the numbers in your hand

How to work the BCG Matrix :

In the four quadrants, the horizontal X-Axis is the market share of your product compared to the overall market. For example, if you are in the CCTV market, the whole market size is 100 crores and you are doing 1 crore in that market, then your relative market share is only 1 %

And on the Y-axis the vertical line you have a growth rate of the market, certain products will be at the beginning of the growth curve like sunrise products and a few are sunset products say, for example, if sanitizer or a mask in the declining trend

Now we will look into each of BCG matrix quadrant:

Cash Cows: A cash cow is your leading product that generates more cash than it consumes. Cash cows are products that have a high market share but low growth prospects.

So what to do: milk it wisely.

Stars: The business units/ products that have a high growth rate with good market share and most importantly, generate cash are considered stars.

Growth sucks cash, so stars consume cash.

Stars can eventually become cash cows. A key takeaway from BCG strategy is to invest in your star products.

Dogs: These are product lines that are close to the business owner’s heart. That’s why this is also called as pets. Dogs or pets are products that have both a low market share and a low growth rate. Pet products might have once helped you to get into business. That’s why business owners have an emotional attachment but no longer help to grow your business.

So what to do with pet products?

Lets us see a classic example of Tata Nano once it was a pet project of Ratan Tata close to his heart. But when Tata find it was not attracting enough customers, the harsh market realities. Tata never hesitated to kill that product line. That’s why Tata’s are Tata’s

Moral of the story: dogs or pet products need to be killed or sold to or at least should not pump with more resources

Question Marks: This is a grey area of business. We do not know it will grow or just a market hype. During pandemic sanitizers had high growth prospects, one of my known contact minted money selling oxygenators, but that was only hype. It was over after a period. Invest in question marks if the product has the potential for growth, or to sell if it does not.

Tool Summary:

Who can use this: Entrepreneurs and Top Management

A word of caution: BCG may not be a useful exercise for start-ups and companies in the growth curve.

BCG is like an X-ray for your business, helps you to get a clear picture, do this exercise once a year, it’s advisable to have your mentor in this exercise who can call a spade as a spade and rose as a rose

Understand whom I am saying

We are just a call away, come let’s play the game of business like grandmasters

Regards

Ramesh. P

Cell:9841052321

Very nice analysis pattern to segregate the factors. BCG matrix as a tool to focus and figure it out nicely.

Makes a lot of sense

Often heard of Cash cow’s terminology.

Now am able to relate it.

Good one Mr.Ramesh.

Keep inspiring.

Need more from you

Great article . Good for entrepreneurs good writeup. As a business and life coach found it very useful to coach my mentees. Good example and clarity. Wishing you ll the best. Sharing is caring. Great job